Featured

Let’s Leverage our Local Housing Market

By Joe Gianelli

Sereno Group – Santa Cruz

February 12, 2015 — Santa Cruz, CA

Attracting more high tech companies and talent to Santa Cruz

In case you haven’t noticed, there’s been more talk lately about the emergence of high tech companies taking root in the Santa Cruz area. What an exciting development! This topic is always interesting to me as I was lured to the Santa Cruz area in 1984 by a not so well know high tech company (at the time) – Intel Corporation. That’s right, many of you may not realize that, long before most of today’s local high tech companies established themselves in Santa Cruz, Intel had a thriving design center at the end of Encinal Street during the mid 80’s.

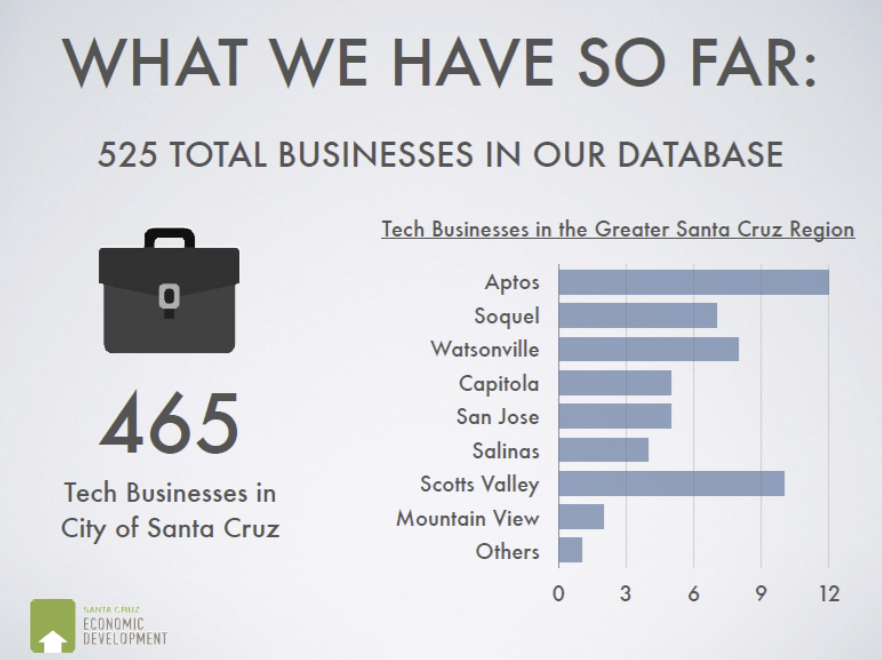

There was a recent news article in the Santa Cruz Sentinel and Santa Cruz Tech Beat reporting that the Santa Cruz Economic Development Office (SC EDO) was compiling a database of all the high tech companies in Santa Cruz and surrounding areas, with the purpose of creating programs to better support high tech growth in our area. To date, the SC EDO has discovered 525 total high tech businesses in Santa Cruz County!

I’m impressed with what the SC EDO is doing thus far. In meeting with them I’d say they’re committed to nurturing the growth of the high tech company foot print in Santa Cruz. Here’s a recent quote regarding this commitment:

I’m impressed with what the SC EDO is doing thus far. In meeting with them I’d say they’re committed to nurturing the growth of the high tech company foot print in Santa Cruz. Here’s a recent quote regarding this commitment:

“The Santa Cruz Economic Development Office holds regular meetings with the tech sector to ensure we are in tune with their needs, including reasonable access to the housing market. As panelists from Looker, Vivo, PayStand, and PredPol recently commented at the Monterey Bay Economic Partnership 2015 Summit, short-term housing may be difficult, but they all emphasized this challenge reflects the positive, high growth tech sector and the value we place on our quality of life. Economic Development continues to work with housing developers as well to ensure they have accurate information for development to meet our housing demands, with several projects already entitled.” — J. Guevara, Economic Development Manager

More recently, the Monterey Bay Economic Partnership (MBEP) held their first economic summit a few weeks back and agreed that housing, or lack of, is “the highest pain point” regarding impediments to business expansion. I would argue that our current housing could be leveraged to better lure high tech talent. More on that below.

As we explore this issue in more depth, let’s begin by looking at today’s local real estate and supporting mortgage markets.

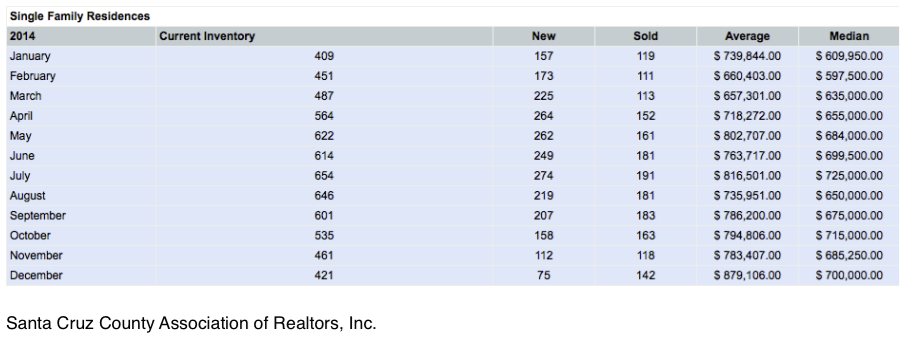

We start 2015 with a local housing market that has a low inventory of homes for sale but at stabilizing prices. As of this writing, there are 480 single family homes for sale on the local MLS service. This represents an inventory of homes that could be sold in about 3 months. This lower inventory tends to push home prices up. However, home prices are currently stabilizing. Some of this is due to fewer home buyers out looking of homes in the winter months. Another force that’s helping stabilize current home prices is the shrinking affordability index, which for Santa Cruz County is down to 17%, according the latest C.A.R. report. This means that the percentage of households that can afford to purchase the median priced home in Santa Cruz County is only 17%. For 2015, unless inventory increases, I see home prices inching up only slightly in the spring due to lower mortgage rates but otherwise remaining stable through 2015.

Most analysts predict that mortgage rates will drift a bit lower in Q1, then begin a slow climb through the year. The predominant thinking here is that as the US economy improves the Federal Reserve will slowly raise their rates later this year. At the time of this writing the average 30-year fixed rate mortgage (conforming) is at 3.75% and the 10-year US treasury yield is at 1.88%. I tend to agree with the analysts but also think that as more demand from foreign buyers of our treasury bonds continues, this demand lowers these bond yields which in turn puts downward pressure on mortgage rates.

Most analysts predict that mortgage rates will drift a bit lower in Q1, then begin a slow climb through the year. The predominant thinking here is that as the US economy improves the Federal Reserve will slowly raise their rates later this year. At the time of this writing the average 30-year fixed rate mortgage (conforming) is at 3.75% and the 10-year US treasury yield is at 1.88%. I tend to agree with the analysts but also think that as more demand from foreign buyers of our treasury bonds continues, this demand lowers these bond yields which in turn puts downward pressure on mortgage rates.

As we think about the prospect of more high tech companies establishing themselves in our community, the current backdrop of single family (for purchase) housing reveals stabilizing prices, historically low borrowing rates, but with low affordability. Because we live in such a beautiful place in this world and have close proximity to the worlds highest concentration of high tech companies, educated resources and monetary capital sources, I’m afraid affordability won’t improve too much in the near future. However, if you think housing is expensive here, take a look at average housing prices in Santa Clara County, San Mateo County or San Franciso. High tech workers over the hill and up the peninsula face far higher housing prices and a more competitive environment. High tech companies over here have a distinct hiring advantage with a more beautiful environment coupled with lower housing costs.

However, the housing problem goes deeper than just affordability.

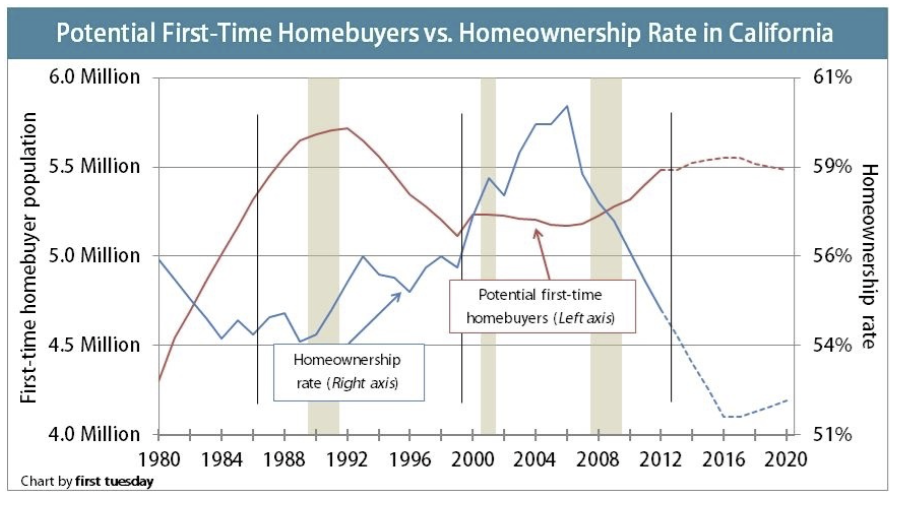

Another reality gripping the housing market is the receding home ownership rate here in California. There are many factors at play here including but not limited to the financial crash of 2008 where credit almost disappeared completely and the subsequent large pool of investors who swooped in and bought homes at distressed prices with all cash offers. These distressed purchases gave rise to an increase supply of homes for rent.

In this environment, we lost a large pool of potential first time home buyers, many who fit the same profile as the young technology professionals our local high tech companies want to lure. What happened is a large portion of these first-time home buyers simply became renters. In the figure below you’ll see that in the first time home buyer age bracket (25-34) there has been a 25% increase in renters establishing new household formation.

In this environment, we lost a large pool of potential first time home buyers, many who fit the same profile as the young technology professionals our local high tech companies want to lure. What happened is a large portion of these first-time home buyers simply became renters. In the figure below you’ll see that in the first time home buyer age bracket (25-34) there has been a 25% increase in renters establishing new household formation.

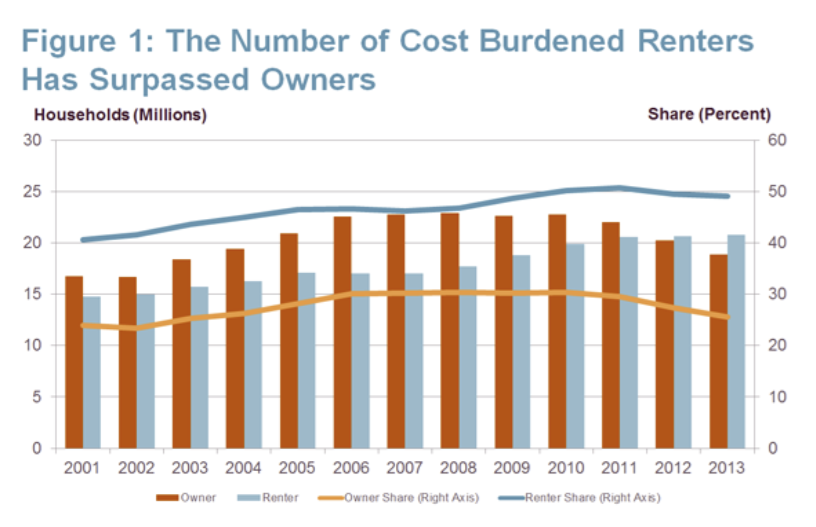

At this point you might be saying to yourself, well, that’s okay, these high tech workers can just continue to acquire housing by renting. Not so fast – renting can be problematic. The first issue is that the rent market in the Santa Cruz area has become more competitive than buying a home. At the time of this writing the average monthly rent for a 3br, 2ba home in Santa Cruz is $3,400 (average price on CraigsList) and most of these homes are seeing multiple inquiries within the first week. Then with renting, there’s the list of things you can’t have or do within in the lease agreement. I’m hearing from clients recently renting talk about an application process that rivals the underwriting process in a home purchase. Another issue with renting in our area is that with monthly rentals this expensive it’s extremely difficult to save money, for things like a down payment on a home purchase. These rent rates essentially can become a trap and prevent people from being able to save. As you can see from the figure below, beginning in 2012 in the US, there are more “cost burdened” renters than property owners.

At this point you might be saying to yourself, well, that’s okay, these high tech workers can just continue to acquire housing by renting. Not so fast – renting can be problematic. The first issue is that the rent market in the Santa Cruz area has become more competitive than buying a home. At the time of this writing the average monthly rent for a 3br, 2ba home in Santa Cruz is $3,400 (average price on CraigsList) and most of these homes are seeing multiple inquiries within the first week. Then with renting, there’s the list of things you can’t have or do within in the lease agreement. I’m hearing from clients recently renting talk about an application process that rivals the underwriting process in a home purchase. Another issue with renting in our area is that with monthly rentals this expensive it’s extremely difficult to save money, for things like a down payment on a home purchase. These rent rates essentially can become a trap and prevent people from being able to save. As you can see from the figure below, beginning in 2012 in the US, there are more “cost burdened” renters than property owners.

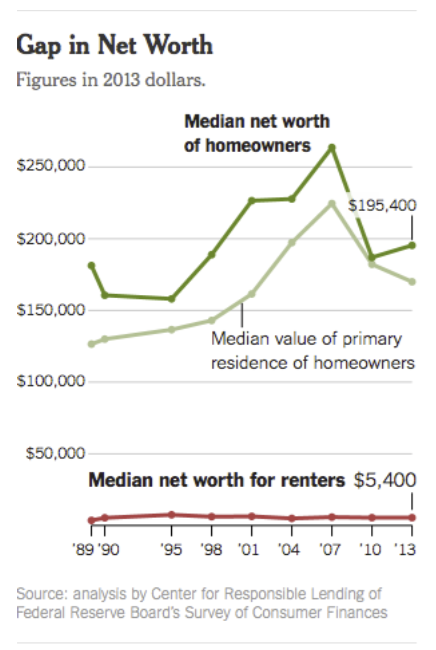

In the next figure below you can see the fairly stunning gap between the net worth of homeowners and renters. The data comes from the Center for Responsible Lending of the Federal Reserve Board’s Survey of Consumer Finances. In 2013, the average net worth for a homeowner was $195,000 while the average net worth for renters was $5,400.

In the next figure below you can see the fairly stunning gap between the net worth of homeowners and renters. The data comes from the Center for Responsible Lending of the Federal Reserve Board’s Survey of Consumer Finances. In 2013, the average net worth for a homeowner was $195,000 while the average net worth for renters was $5,400.

While renting is perfectly fine for short term housing needs, such as when high tech workers are relocated to our area, home ownership has more benefits when seeking longer term housing. As we seek to encourage the ongoing growth of high tech companies in our community, we should also put these young professionals in a position where they can create longer term net worth for themselves and family.

While renting is perfectly fine for short term housing needs, such as when high tech workers are relocated to our area, home ownership has more benefits when seeking longer term housing. As we seek to encourage the ongoing growth of high tech companies in our community, we should also put these young professionals in a position where they can create longer term net worth for themselves and family.

Yes, it’s still expensive to live in Santa Cruz County but I feel that in order to attract highly educated and skilled high tech workers to our area – our local high tech companies should fully leverage our housing market and beautiful environment. I have put together a program that makes access to home ownership in Santa Cruz easier.

###